The Missing Link Between Natural Hazard Risk and Insurance Markets

Is parametric insurance the missing link between environmental risk and financial protection?

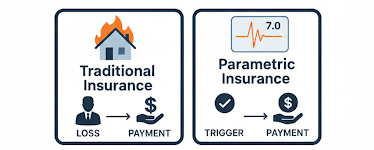

Traditional insurance is indemnity-based. After a wildfire destroys a home, losses are covered through standard homeowner policies. But the process begins only after the damage occurs, and it can be long and complex. While smaller claims may settle within months, full rebuilds after total losses can take years. Policyholders must document damaged items, provide receipts, and navigate detailed verification by claim adjusters. After surviving a traumatic event like a wildfire, the claims process itself can become another burden.

Parametric insurance takes a different approach

Instead of reimbursing documented losses, payouts are triggered automatically when a pre-agreed physical indicator is met, such as wind speed, rainfall intensity, or central pressure. Payment depends on the event, not on the assessed damage.

Traditional insurance links loss assessment to payment; parametric insurance links a pre-defined trigger to payment.

A recent example is Hurricane Melissa, a Category 5 storm that made landfall in Jamaica in late 2025 with wind speeds of 185 mph. The storm met Jamaica’s pre-defined parametric trigger under its policy with CCRIF SPC (Caribbean Catastrophe Risk Insurance Facility). As a result, Jamaica received over US$91.9 million within two weeks of landfall.

In addition, Jamaica held a USD 150 million catastrophe bond arranged by the World Bank, which was also triggered. Liquidity arrived quickly, exactly when it was most needed.

Many Caribbean countries now rely on parametric insurance as a pooled risk-transfer mechanism. It provides rapid post-disaster liquidity and reduces reliance on lengthy claims assessment processes.

But parametric insurance is not without challenges

The central issue is basis risk: the mismatch between the trigger and actual losses. A poorly designed contract may fail to pay when damages are severe, or pay when losses are limited. Designing effective parametric products requires careful selection of physical indicators and robust calibration.

This is where new research becomes critical

Recent work by my colleagues demonstrates how hydrologic and weather indicators can be used to design parametric insurance products for hydropower systems (Cuppari et al., Nature Communications, 2026). Advances in remote sensing now make it possible to construct contracts even in regions with limited ground-based gauges, particularly important for developing countries.

The key challenge, and opportunity, lies in reducing basis risk through better data, modeling, and contract design.

As climate extremes intensify, the question is no longer whether risk will increase. The question is whether financial systems can adapt.

Will parametric insurance see broader adoption in the United States? That remains uncertain. But as wildfire, drought, and hurricane risks escalate, the demand for faster, more transparent risk-transfer mechanisms may grow.