Green Bond and Carbon Emissions

Evaluating the causal impact of municipal green bonds on local carbon emissions using causal machine learning

Green Bond Issuance and Carbon Emissions: A Causal Machine Learning Assessment

Citation: Li & Adriaens (2025), Environmental Science & Technology

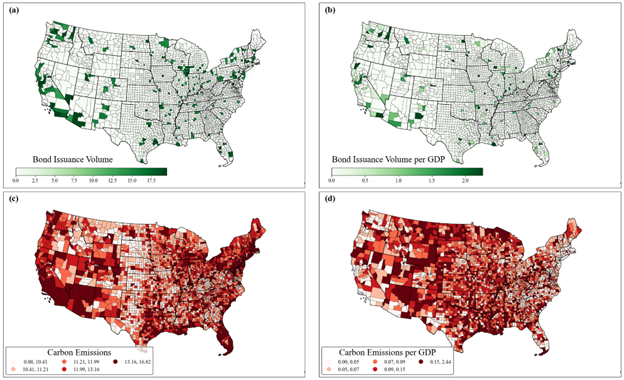

This study evaluates whether U.S. municipal green bonds issued between 2009 and 2019 actually reduce local carbon emissions, and how those effects vary across regions and economic conditions. Using a causal forest model embedded within a double machine learning framework, we estimate how changes in green bond issuance influence county-level CO₂ emissions over time.

Key Findings

1. Green bonds lead to measurable emission reductions

We detect statistically significant CO₂ reductions in the 1–3 years following issuance. Effects grow over time, consistent with delays in infrastructure project completion.

- A 1% increase in issuance volume results in roughly a 0.039% reduction in emissions two years later.

- Estimated abatement cost: ~$192 per ton CO₂, demonstrating competitive cost-effectiveness relative to many mitigation pathways.

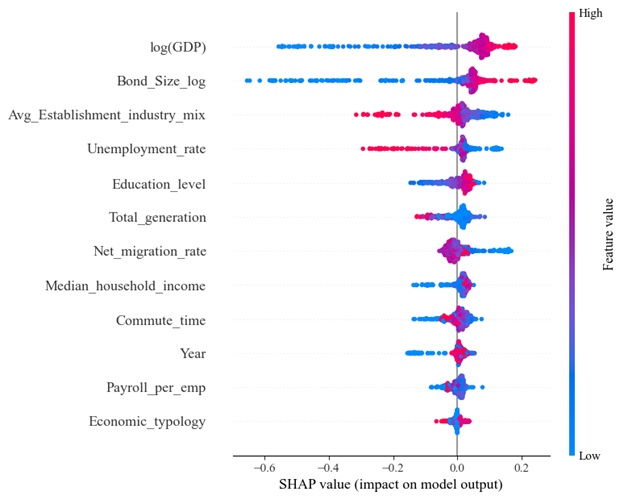

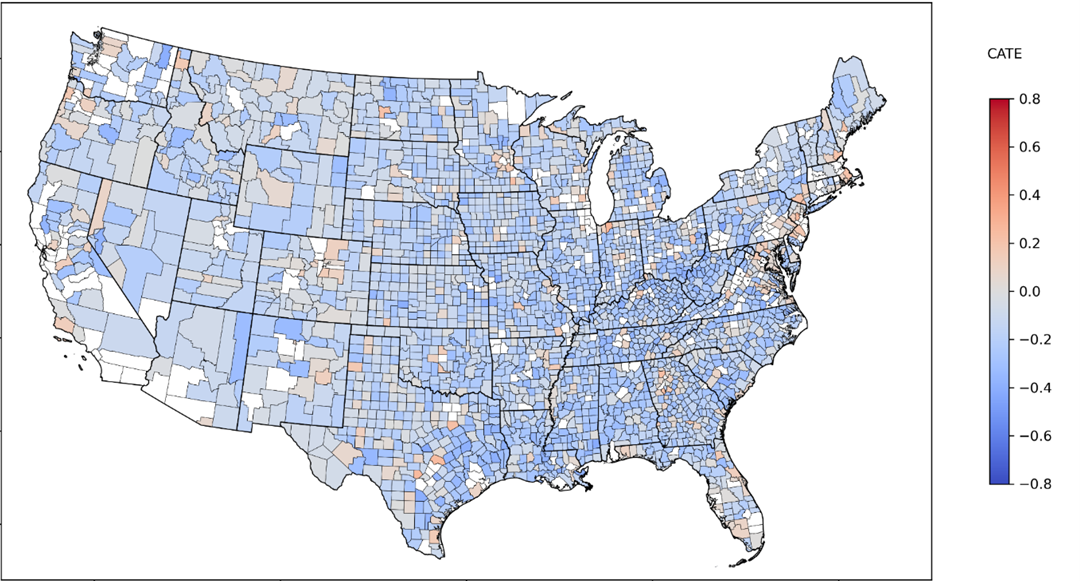

2. Impacts vary widely across counties

Green bond effectiveness is highly spatially heterogeneous.

- Counties with more small and medium enterprises, lower payroll per employee, and smaller establishment sizes show the largest reductions.

- These areas may depend more on public financing to implement carbon-reducing projects.

3. Certified vs. self-labeled green bonds show similar outcomes

Third-party certification does not consistently increase emission reductions in municipal markets, although the certified sample is small.

4. First-time issuers also benefit, but with more variability

Counties issuing their first green bond experience average emission reductions, though estimates are less precise due to selection patterns and wider heterogeneity.

5. Forward-looking policy implications

The causal ML structure allows projecting future emission impacts under changing socioeconomic conditions (e.g., payroll growth, urbanization, industrial structure). This provides a pathway for scenario-based planning and prioritizing counties where green finance yields the greatest environmental return.

Why It Matters

Municipal green bonds are expanding rapidly as cities seek climate finance solutions. This study provides the strongest evidence to date that:

- Green municipal bonds can reduce carbon emissions,

- Those benefits are uneven, and

- Targeted issuance strategies can improve outcomes.

These insights support policymakers, local governments, and investors who are designing next-generation climate finance strategies.